It’s useful to periodically compare your AR turnover ratio to competition in the same industry. This provides a more meaningful analysis of performance rather than an isolated number. However, if you have a low ratio long enough, it’s more indicative that AR is being poorly managed or a company extends credit too easily. It can also mean the business serves a financially riskier customer base (non-creditworthy) or is being impacted by a broader economic event. Happy customers who feel invested in you and your business are more likely to pay up on time—and come back for more. Focus on building strong personal relationships with your customers to keep the cash flow coming in.

- For example, collecting on office supplies is a lot easier than collecting on a surgical procedure or mortgage payment.

- If you never know if or when you’re going to get paid for your work, it can create serious cash flow problems.

- Lower turnover ratios indicate that your business collects on its invoices inefficiently and is cause for concern.

- Managers should continuously track their entity’s receivables turnover ratio on a trend line to observe the gradual ups and downs in turnover performance.

- Consider the following methods and if they could help you forecast future performance and make more informed decisions.

- Now we can use this ratio to calculate Maria’s average collection period ratio which would reveal the average number of days the company takes to collect a credit sale.

What is the Accounts Receivable Turnover Ratio? Formula & Examples

And more than half of them cite outstanding receivable balances retained earnings as their biggest cash flow pain point. Liberal credit policies may initially be attractive because they seem like they’ll help establish goodwill and attract new customers. Although that may be true, nothing negates positive feelings like having to hassle someone over unpaid bills. Of course, it’s still wise to make sure you’re not too conservative with your credit policies, as too restrictive policies lead to loss of clients and slow business growth. It should also be noted, any business model that is cyclical or subscription-based may also have a slightly skewed ratio.

Next Steps for Financial Health

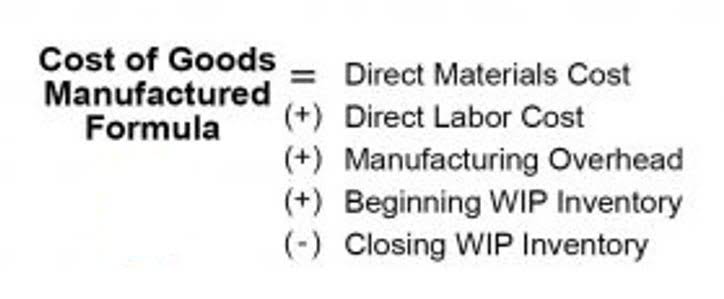

If the opening balance is not given in the question, the closing balance should be used as denominator. A low ratio can indicate potential cash flow issues and inefficiencies in the credit and collection processes, possibly leading to higher bad debt expenses. Given the accounts receivable turnover ratio of 4.8x, the takeaway is that your company is collecting its receivables approximately five times per year. Now for the final step, the net credit sales can be divided by the average accounts receivable to determine your company’s accounts receivable turnover. If the accounts receivable turnover is low, then the company’s collection processes likely need adjustments in order to fix delayed payment issues. The Accounts Receivable Turnover is a working capital ratio used to estimate the number of times per year a company collects cash payments owed from customers who had paid using credit.

- Average receivables is calculated by adding the beginning and ending receivables for the year and dividing by two.

- The ratio shows how well a company uses and manages the credit it extends to customers and how quickly that short-term debt is collected or is paid.

- We’re a headhunter agency that connects US businesses with elite LATAM professionals who integrate seamlessly as remote team members — aligned to US time zones, cutting overhead by 70%.

- Receivables turnover specifically focuses on how well a company collects outstanding payments owed by its customers.

- If a company loses clients or suffers slow growth, it may be better off loosening its credit policy to improve sales, even though it might lead to a lower accounts receivable turnover ratio.

- The higher the number of days it takes for customers to pay their bills results in a lower receivable turnover ratio.

- If collection procedures and credit policies remain unchanged, receivable turnover days will rise in tandem, increasing the investment tied up in receivables.

Cash Flow Management:

You may have an inefficient collections process, or your customers may be struggling to pay. Use your ratio to determine when it’s time to tighten up your credit policies. You can use it to enforce collections practices Bookkeeping for Chiropractors or change how you require customers to pay their debts.

The accounts receivables turnover ratio measures the number of times a company collects its average accounts receivable balance. It is a quantification of a company’s effectiveness in collecting outstanding balances from clients and managing its line of credit process. The receivables turnover ratio measures how efficiently a company collects payment from its customers over a period of time. It is an important metric in evaluating the financial health and working capital management of a business.

Step 2: Calculate your average accounts receivable

However, it can never accurately portray who your best customers are since things can happen unexpectedly (i.e. bankruptcy, competition, etc.). By understanding the factors influencing your AR turnover ratio, you can adjust your credit policies to minimize risk and encourage timely payments. If your model predicts a decrease in your AR turnover ratio, you can proactively take steps to improve collections and manage your cash flow. They found this number using their January 2024 and December 2024 balance sheets.

- This indicates that a company is efficiently collecting payment from customers in a timely manner.

- In denominator part of the formula, the average receivables are equal to opening receivables balance plus closing receivables balance divided by two.

- Integrating AI into P2P processes transforms procurement from a manual, error-prone task into a highly efficient workflow.

- On the other hand, in industries with traditionally longer sales cycles, a ratio of 5 might be deemed acceptable.

- A high receivables turnover ratio might also indicate that a company operates on a cash basis.

- Therefore, it takes this business’s customers an average of 11.5 days to pay their bills.

- This inaccuracy skews results as it makes a company’s calculation look higher.

Keep copies of all invoices, receipts, and cash payments for easy reference. And create records for each of your vendors to keep track of billing dates, amounts due, and payment due dates. If that feels like a heavy lift, c life, consider investing in expense tracking software that does the organizing for you. Companies should consider seasonality when analyzing their receivables turnover ratio.

Formula For Accounts Receivable Turnover Ratio

Encourage more customers to pay on time by setting a clear payment due date, sending detailed invoices, and offering additional payment options. First, you’ll need to find your net credit sales or all which of the following represents the receivables turnover ratio? the sales customers made on credit. It suggests how well a company is working on the collection of credit sales, which indicates how fast the company gets its hands on capital.

High receivables turnover ratios

A low receivables turnover ratio might be due to a company having a poor collection process, bad credit policies, or customers that are not financially viable or creditworthy. In financial modeling, the accounts receivable turnover ratio is used to make balance sheet forecasts. In order to know the average number of days it takes a client to pay on a credit sale, the ratio should be divided by 365 days. The accounts receivable turnover ratio (also called the “receivable turnover” or “debtors turnover” ratio) is an efficiency ratio used in financial statement analysis. It demonstrates how quickly and effectively a company can convert AR into cash within a certain accounting period. Receivables turnover ratio is more useful when used in conjunction with short term solvency ratios like current ratio and quick ratio.

Recent Comments